Investing in artificial intelligence stocks represents one of the most promising opportunities for 2025 and beyond. This comprehensive guide will help you identify, evaluate, and select the best AI stocks to build a robust investment portfolio.

Why Invest in AI Stocks in 2025?

The artificial intelligence market is projected to experience exponential growth through 2025 and beyond. Companies integrating AI technologies are positioned to disrupt traditional industries, create new markets, and deliver substantial returns to investors who identify the right opportunities early.

Key Investment Criteria for AI Stocks

Essential Factors to Consider

- Technology Leadership: Research companies with proprietary AI technologies and sustainable competitive advantages

- Market Position: Evaluate companies leading in their respective AI application domains

- Financial Health: Analyze balance sheets, revenue growth, and profitability metrics

- Growth Potential: Assess addressable markets and scalability of AI solutions

- Management Team: Review leadership experience in AI and technology execution

- Risk Assessment: Consider regulatory, competitive, and technological risks

AI Stock Categories for 2025 Investment

1. AI Infrastructure Companies

These companies provide the foundational technologies that power AI systems, including semiconductors, cloud computing platforms, and development tools.

2. AI Software and Platform Providers

Companies developing AI algorithms, machine learning platforms, and enterprise AI solutions across various industries.

3. AI-Enabled Applications

Businesses leveraging AI to enhance existing products or create new services with significant market potential.

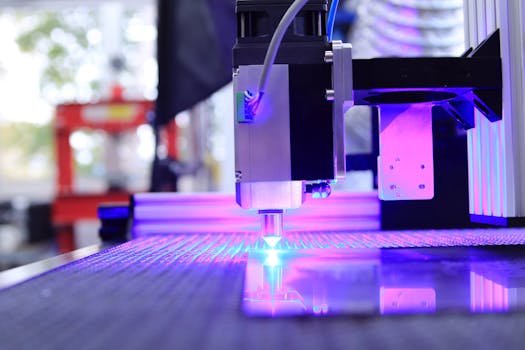

4. Specialized AI Hardware

Companies focused on developing specialized processors and hardware optimized for AI workloads.

Portfolio Construction Strategies

Building a successful AI stock portfolio requires careful planning and diversification. Consider these approaches:

Portfolio Allocation Strategy:

- Core Holdings (60%): Established AI leaders with proven track records

- Growth Opportunities (25%): Emerging AI companies with high growth potential

- Speculative Positions (15%): Early-stage AI innovators with disruptive technology

Rebalancing Schedule:

- Quarterly review of portfolio performance

- Annual rebalancing to maintain target allocations

- Continuous monitoring of industry developmentsRisk Management in AI Investing

While AI stocks offer significant potential, they also carry unique risks that require careful management:

- Technological obsolescence and rapid innovation cycles

- Regulatory uncertainty and data privacy concerns

- Valuation volatility and market sentiment shifts

- Competition from both established players and startups

- Execution risk in AI implementation and adoption

Monitoring and Evaluation Framework

Establish a systematic approach to track your AI investments:

Key Performance Indicators:

- Revenue growth from AI products/services

- Customer adoption and retention rates

- Research and development investment levels

- Patent filings and intellectual property development

- Partnership announcements and market expansion

- Competitive positioning and market shareFrequently Asked Questions

What makes 2025 a particularly good year for AI stock investments?

2025 represents a critical inflection point where AI technologies are expected to move from experimental phases to mainstream adoption across multiple industries, creating significant value for companies that successfully implement and scale AI solutions.

How much of my portfolio should I allocate to AI stocks?

Allocation depends on your risk tolerance and investment horizon. Conservative investors might allocate 5-10%, while those with higher risk tolerance might allocate 15-25%. Always maintain proper diversification across sectors and asset classes.

What are the biggest risks specific to AI stocks?

Key risks include technological disruption, regulatory changes, data privacy concerns, high valuation multiples, and the winner-take-most dynamics that can leave many companies behind while a few dominate.

Should I focus on pure-play AI companies or established tech companies integrating AI?

A balanced approach is recommended. Pure-play AI companies offer focused exposure but higher volatility, while established tech companies provide stability with AI growth optionality. Consider both based on your investment objectives.

How do I stay updated on AI investment opportunities?

Follow industry publications, company earnings reports, technology conferences, and regulatory filings. Consider joining investment communities focused on technology and AI to share insights and research.

Final Thoughts

Investing in artificial intelligence stocks for 2025 requires a strategic approach combining thorough research, disciplined portfolio management, and continuous learning. The AI revolution is still in its early stages, offering substantial opportunities for investors who can identify sustainable competitive advantages and manage risks effectively. Start with a solid foundation, diversify appropriately, and maintain a long-term perspective to capitalize on this transformative technology trend.